Highlights of New Amendments in Indian Trade Marks Rules 2017

Over the past five years there has been major improvements in the patent and trademark domains in India, majorly due to its obligations arising out of TRIPS. In 2012, the online submission of trademark and patents were introduced using digital signature, though contrary to online systems developed and implemented in other countries such as USA, UK, AU, wherein no digital signature is necessary. In addition to technological improvements, there has also been extensive recruitment of examiners and administrative staff to expedite and enhance the whole process in general. This 2017 amendment is relatively equivalent to the 2002 amendment, which also had substantial revisions.

Application forms and formats

Applications have seen a sea change so as to suit them with the new amendments. Old forms, approximately 60, have been scraped away, replaced by eight new forms TM-A, TM-O, TM-P, TM-C, TM-U, TM-G, TM-M, TM-R.

Application Fee

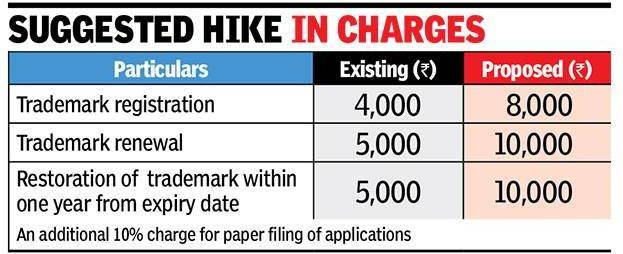

Aside from the above, the trademark office has also been revising the fee structure from time to time, albeit, fortunately, miniscule increments, from 2500, 3500 to 4000 and now stands at 4500 for individuals, startups and small enterprises and 9000 for all other cases through e-filing and for paper filing, at 5000 and 10000, respectively. It was originally proposed to see a 100% increase but in view of the large public dissent, the fee has been revised only marginally.

Renewal Fee

Renewal fee which originally was Rs. 5000 has now been revised to Rs. 9000 for e-filng and Rs.10,000 for paper filing.

Application for well-known mark

Application to request to include a trademark in the list of well-known marks has been fixed at Rs. 100,000 (one lakh) per mark. This procedure has been elaborately deal with under Rule 124 of New Trade Marks Rules 2017.

Services of Notices via email

Henceforth, services of any notices would also include notices through email. This is likely to significantly decrease the pendency of the application – for example, automating the objection notices and corroborating them with response received within the specific deadline of one month would have a huge impact on pending applications.

Recognition of startup-up and small businesses

The new Rules specifically recognizes the Startup and Small Business, which as per the new rules is a business entity or individual described under Section 7 of the MSME Act 2006, which says for manufacturers, “a medium enterprise, where the investment in plant and machinery is more than five crore rupees but does not exceed ten crore rupees” and for service providers, “a medium enterprise, where the investment in equipment is more than two crore rupees but does not exceed five crore rupees.” So, the new revision would largely not affect the small businesses and individuals.

It is expected that these new amendments when brought into full effect would significantly improve the overall efficiency of the trademark system in India.